The Most Common mistakes in Market Trading

The Most Common mistakes in Market Trading

Looking into any field you can see two types of people. One is successful people and the other is unsuccessful. Actually, what is the difference between the two? Successful people are willing to do all the things right what others are unwilling to do. However, in any field, anyone can make mistakes. Even in your day-to-day life, you make many mistakes. So, no matter, whether you are a small investor, inexperienced beginners or smart professionals. There is chance to make mistakes (initially more). If there is no hard work to understand and correct these mistakes, you tend to lose money in market. Market will take charge /fees for your mistake in terms of losses. Trader keep thinking that Market is going all time high, why my portfolio stocks are still down OR Market is falling, but I have losses in my short position. Next time they buy, it going down as market is falling down. You just have to do is “Build up your weaknesses until they become your strong points”. Below are very common mistake trader do and repeat, which leads to eating out your hard-earned money sometime in big way.

Not having Trade plan and Not having Trading rules based on Trading plan

When you buy a ticket for a bus journey, you always check the details for bus route, timings, Stoppage, pricing and destination etc. While taking position, most of trader are not have any plan and answer for following questions.

Why I’m entering at this point?

What is the basis of entering into trade?

What is the Target/destination?

On what conditions, I would exit before my Target/ destination.

How much money I should spend?

Should I borrow money for this Trade/trip?

How much time I’m having?

Most of trader do not have such plan for entering and exit. They are taking position just like boarding the bus without knowing bus timings, Stoppage, pricing and destination.

Absolute price of Stock comparison.

Most of trader take trade in the stocks whose price is less thinking that it will become many folds. They assumed price at 10 may easily reach 20 mean doubling the investment rather than price 1000 is difficult to reach 2000. Many people think that it is better to buy large amount of low-priced stocks rather than fewer shares of higher-priced stocks. But its sound wired. The most useful way is to buy some good quality stocks of higher price besides of buying lots of lower valued price stocks. Also low-priced stocks may cost you more.

Check below charts for HDFC Ltd. and Coal India. HDFC was good if buy at 1200 in 2016 which went up to 2200 in 2019 whereas Coal India was bad if buy at 425 in 2016 and went till 200 in 2019.

Buy for stocks, which has fall down much. Sell for stocks, which has risen much, and wait for fate to turn.

Trader buy the stocks, which has fallen much, thinking that now it will not fall much and it will rise and wait and keep praying till their losses are beyond control. . Check above chart of COAL India, Trader tend to buy when it falls from 400 to 350 levels. Even at 300 thinking that it has fallen much, but trader trapped and waiting for turnaround in their fate.

Myth that long term always pay.

Most of trader think that I should buy and forget my holding and will give to my heir. When you buy plot or land, you keep an eye for development around and keep always check whether any trespassing is there or not and accordingly take action. Trader just buy and forget and later they came to know even in 5 years or 10 years, they are not getting what they invested. For these type of trader, my advice to put money in safe zone like Fixed deposit etc. Check chart for TATAMOTORS, BHEL invested in 2004, and check in 5 years return, 10 years return. There is no equation that in 10 years , returns will be more than 5 years or vice versa.

Buy for Averaging in downturn and sell for averaging in Uptrend.

Trader keep on averaging the price when the stock is beaten down and down. Also, trader keep on averaging their short position if the stock price goes up and up thinking that it will come down. They trapped badly in such situations and faces heavy losses and keep cursing market. Simple follow rule BUY on dips in UPTREND and Sell on RISE in DOWNTREND. Trader forget this simple rule.

Refer the chart of TATAMOTORS, trader keep buying on every fall and average their position and this led to heavy losses and got trapped with their hard-earned money till the time they don’t know.

Taking Trade solely based on Tips/Advice or news.

Many traders just instantly react to market news and take Trade without thinking of Trend and Chart study. They sometime follow the live news channels; follow what is being told, and book heavy losses. Trader sometime fail to understand the correct advice and without doing any homework, take trade and fails to understand market. If check, big Green candle for news stated oil tanker attack, this led to instant jump in crude and trader took their buy positions and trapped into trade that led to heavy losses.

Wrong practice about market.

There is numerous material available in books, websites, YouTube channels, social Medias. Those content are not even validated and trader take their position based on those practices /strategies. These contents are free to upload, free to download, free to access. Beginners start putting their hard-earned money by following this invalidated information. There are very less successful traders than successful Trading Gurus. This is because these people earned based on the content viewed/shared and they are not accountable for trader losses. If one is earning very well in Market, Will he/She be having time for the video making (Free) and asking for subscription. Practice should be on perfect things, If you have taken training from any institute , and still not profitable mean that training was not worth because you haven’t taken training for any examination. Just an example below, trader follow smaller and bigger moving average cross over strategy and make losses, refer below chart for the same that crossover says buy trade in one time and short sell in other time. If you do this (buy and short) on same day, there is terrible wrong with you.

Psychology and Emotions

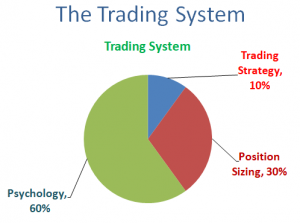

If you have best trading strategy and you know how to do position sizing then do you think that you will be a successful trader, answer is no. Because 60% success come from the psychology factors, if you not able to control psychology like emotion, fear, greed you are not a successful trader. 90% trader loss money only because of their psychology. If Market is not going as per your selection and your practice and study says to exit, you need to exit, no other thought and accept the losses by hitting out by Stop Loss. Don’t overtrade to make up the losses and don’t play with your trade plan and guidelines. Unable to control the emotions may lead to wrong trade and more losses.

So dear Trader friends, please avoid such common mistakes. You cannot get rich through Trading in just few minutes, days, weeks or months. It takes time to understand the system and rules of Stock market. Market examines human psychology which generally includes fear, greed, over-confidence, anger, dejection, unhappiness and disappointment. You need to accept the truth and continues to go with a spirit of learning and not giving up for proficiency. This is how, you can become a good trader. If you thinking to be a good trader, it is important for you to learn from your mistake, by analyzing what went wrong , keep learning from different reliable sources and testing it by yourself to make you understand more deeply. Be realistic in terms of trading and you can not cheat yourself.

1 Comment

Join the discussion and tell us your opinion.

Awesome article, Great thought and knowledge.